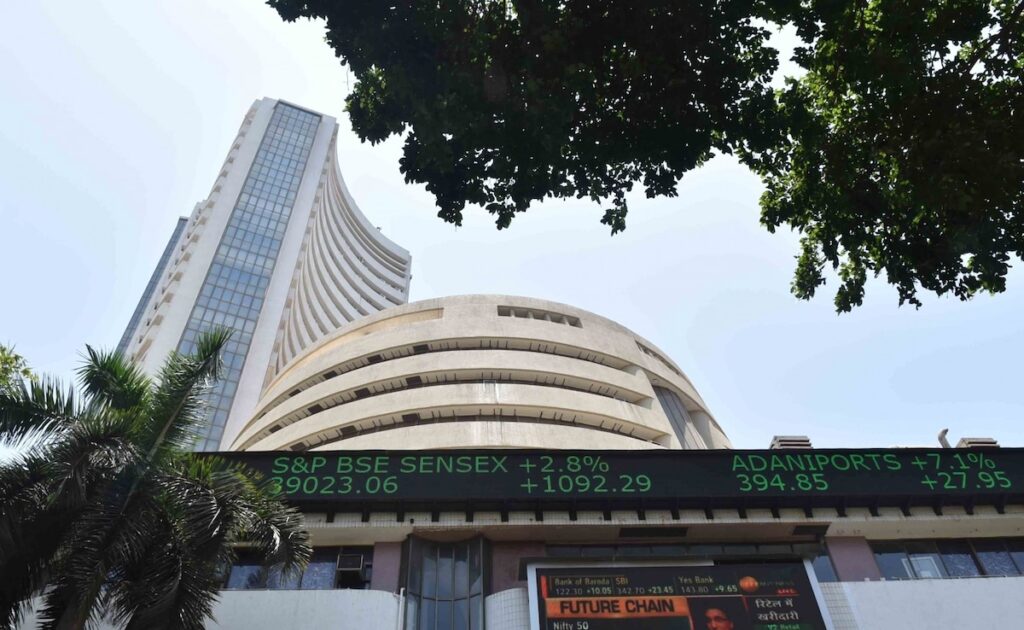

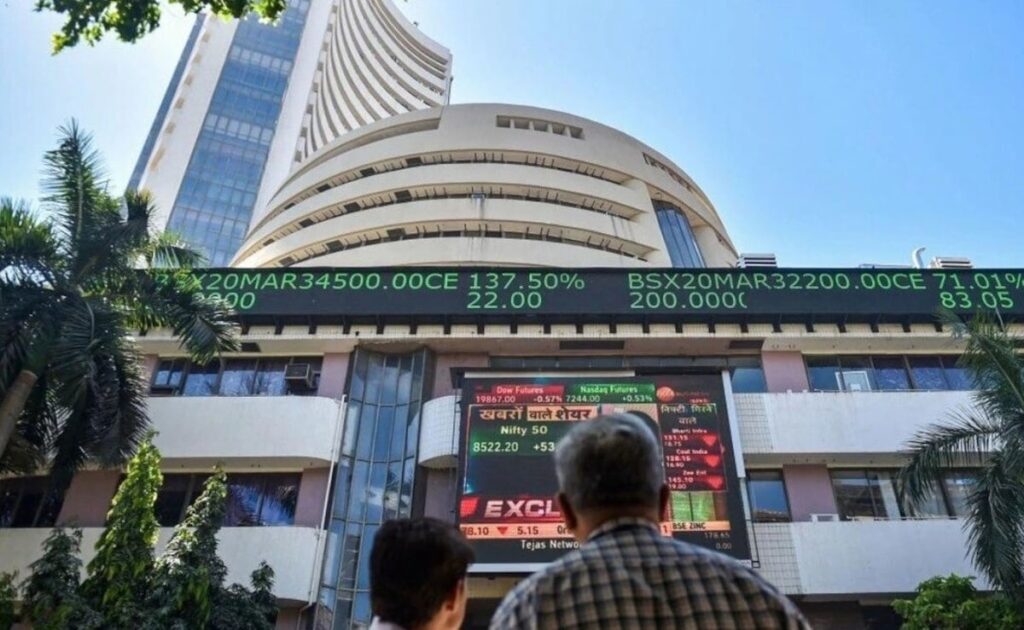

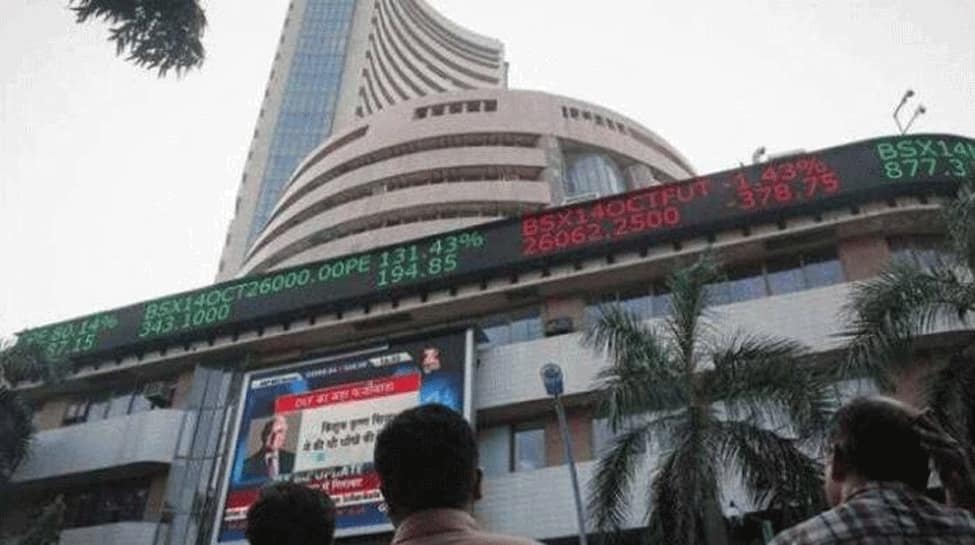

Indian Stock Markets End Lower Due To Weak Global Cues | Economy News

New Delhi: Indian equity markets ended lower on Thursday due to weak global cues, especially from the Asian markets which affected investor sentiment. At the closing bell, the Sensex fell by 644.64 points, or 0.79 per cent, closing at 80,951.99. During the day, it moved between 80,489.92 and 81,323.24.

Similarly, the Nifty ended lower by 203.75 points, or 0.82 per cent, at 24,609.70. “Technically, Nifty formed a red candle on the daily chart, suggesting weakness,” said Hrishikesh Yedve of Asit C. Mehta Investment Interrmediates Ltd.

“However, the index found support around the 21-Day Exponential Moving Average (21-DEMA), which is placed near 24,445. On the upside, 25,000 will act as a key resistance level for the index in the short term,” he added.

On the 30-share index, the top losers were from sectors like auto and consumer goods. Companies such as Power Grid, Mahindra and Mahindra, ITC, Bajaj Finserv, and HCL Technologies saw significant declines.

On the other hand, IndusInd Bank led the gainers pack on BSE by rising 1.82 per cent. It was followed by Bharti Airtel which climbed 0.44 per cent, Ultra Tech Cement, which close the intra-day trading session with a gain of 0.10 per cent.

In the broader market, both the Nifty Midcap100 and Nifty Smallcap100 indices ended in the red, falling by 0.52 per cent and 0.26 per cent, respectively. On the sectoral front, selling was seen across the board, with the exception of Nifty Media, which managed to stay in the green.

The worst-hit sectors were IT, Auto, FMCG, Consumer Durables, and Oil and Gas — all of which declined by over 1 per cent. The Nifty FMCG and consumer durables sectors slipped by more than 1 per cent, while the Nifty IT and Pharma indices dropped by 0.87 per cent and 0.9 per cent respectively.

The fear gauge, India VIX, slipped by 1.65 per cent to close at 17.26, indicating a slight easing in market volatility. Despite a notable improvement in India’s PMI in May and uptick in fiscal scenario, ongoing uncertainty around trade negotiations and persistent global market volatility are likely to keep Indian equities in a consolidation phase in the near term, said analysts.